One of the best funding sources for long term care comes from nonqualified deferred annuities!

Who is the right client for this? It’s simple – that person is …

- someone who is between the ages of 75 and 85,

- is a nonqualified deferred annuity with gain, and

- owns nonqualified deferred annuities that are NOT intended for income.

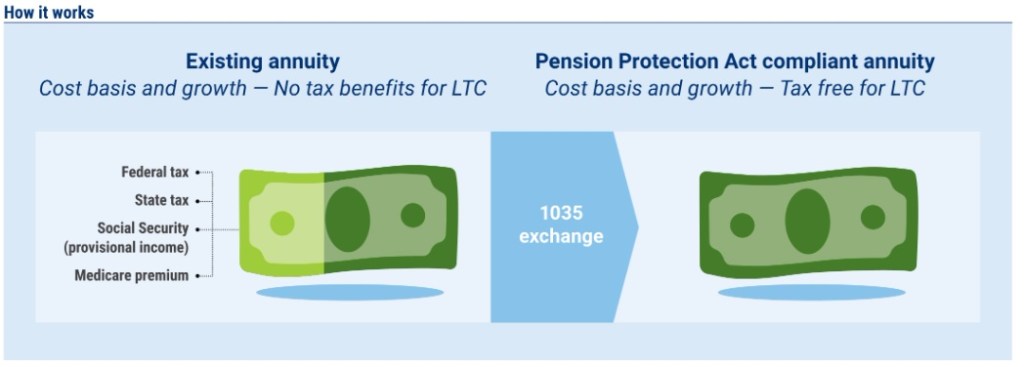

A simple 1035 exchange into an Annuity Care product allows the gains in their existing annuity to be transformed into a tax-free resource to be used to fund a long-term care event.

When you consider that 73% of nonqualified deferred annuities are earmarked as an emergency fund for a healthcare situation1 including paying for extended care, you can see the importance of this strategy.

The Annuity Care solution is designed to provide tax-free benefits for long term care support and services regardless of where they are received – in a facility like a nursing home, at home (where most people prefer to be), or other venues such as adult day care, assisted living, and hospice.

Your clients with up to $1.5 million in nonqualified annuity value can be instantly approved when you submit the application electronically! The only caveats are that they cannot be declined for a OneAmerica Asset Care or Annuity Care in the pas and that they can answer the following questions favorably:

If your client can answer “no” to the following underwriting questions, they are a good candidate for an annuity based strategy:

You can learn more at the Annuity Care (base-only) resource page.

Here is what I would like from you … identify 2 or 3 clients who fit the profile, introduce the concept of improving the position using a “new style” annuity THEN contact me!

1 Source: https://www.annuity-insurers.org/wp-content/uploads/2013/10/2013-Gallup-Survey.pdf; The Committee of Annuity Insurers, Survey of Owners of Individual Annuity Contracts (The Gallup Organization and Mathew Greenwald & Associates, 2013).”

You must be logged in to post a comment.