A week ago, I shared my opinion about the criticism that some people have directed at asset-based / linked-benefits LTC products. And, I received some critical reactions to my position.

First – I own both types of policies and each has their own specific reason for the purchase.

The traditional solution was a cost-effective approach that I took that offers limited (3 years) of benefits. The asset-based solution was purchased because I do not believe in the averages and both longevity and severe cognitive decline is baked into my family history.

So – don’t tell me that average is okay when I certainly do not feel comfortable with average. I shared my family’s story.

A personal experience is a major motivator to a planning discussion. That is a fact! And, that experience should be a driving force in the crafting of any LTC funding strategy (insured or self-funded).

I’ve heard too much criticism about considering a lifetime benefit and the terminology of unlimited is not accurate.

I cry foul on the latter statement as unlimited means never running out of benefits from a policy when on claim. Unlimited has nothing to do with how deep a pool is – it has everything to do with how long that pool will provide resources. That is the benefit of an unlimited lifetime benefit.

Let me share this graphic with you to demonstrate my point.

This simply demonstrates the benefits paid over certain periods of time. When durations are short, everyone is a hero and an argument that purchasing a long duration plan is a waste can be made.

But, we never know how long any one of us will need care. In fact, we can’t even predict IF we will need care. It all comes down to intuition and experience aka a wild guess.

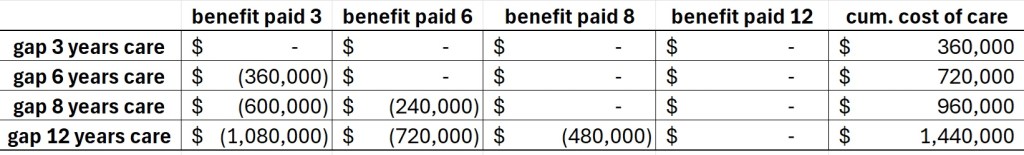

This next piece demonstrates the gap that might be incurred if you guess wrong.

I am sure that I will take criticism because this is “unrealistic” or doesn’t include inflation or some other reason. But, it does demonstrate the gap that one might experience when they select the wrong duration for their LTC policy.

Let me paint this picture.

We all know the mountain climbing story and how that whe you get to the top you are only halfway there and that you need to manage the decent as well. Typically, this is an income story but layer into that a healthcare incident that requires the use of long term care support and services. That is a potential cliff that we can walk off without an adequate plan.

I say adequate because the length of that need will determine the suitability of the plan that you preselected. If it’s a long term need like my family experienced, 3 years still would have left a gap of $1 million.

As I mentioned earlier, we are guessing when we devise a solution. Downplaying the potential impact of a long duration care event is irresponsible. And, saying that statistically the odds of using a lifetime benefit is small. Tell that to my family – we’ve lived it.

One last point that I want to make about unlimited lifetime benefits – I’ve never heard a family say that they regretted having a pool of resources that would provided benefits for the lifetime of their loved one. I have heard – “I wish we had more.”

Want funding ideas?

You can contact me or one of my internal sales partners – Justin Fox at (844) 658-3725 & justinfox.isp@oneamerica.com or Nick Angelov at (844) 623-4251 & nick.angelov@oneamerica.com

You must be logged in to post a comment.