We have been talking about underwriting for the past few weeks, specifically the introduction of Flex Underwriting that was rolled out in 35 states on October 6.

If you want a 3 minute overview of the program, we have one on the Flex Underwriting Resource page. You will also find there the revised process guide focusing on underwriting and process. This leads me to today’s subject – the flowchart of Flex Underwriting.

Remember, Flex underwriting is intended to make the process quicker and the ideal way to do this is submitting the application via eApp. Last week, I shared an overview of the paper process which still involves the “Part II Phone Interview” from Illumifin.

With eApp and Flex Underwriting, you cut out the Part II interview by Illumifin and have the option to either a) complete the “Part II” yourself or b) have the client complete the “Part II” themselves. In both cases, the questioning is reflexive and driven by the answers that are submitted on the application.

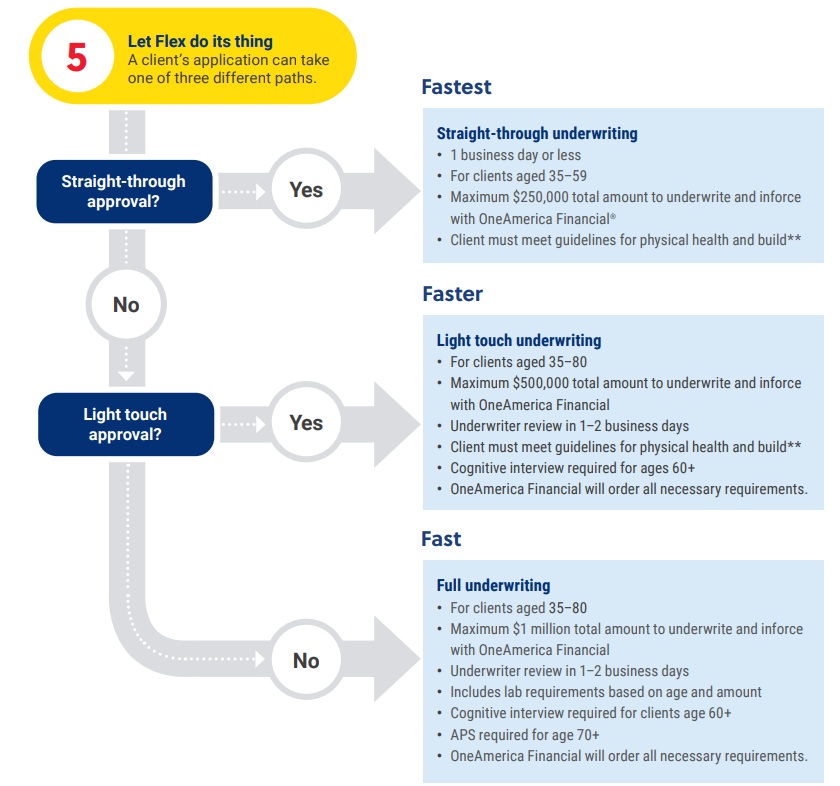

Once the “Part II” is completed, it moves to underwriting for approval. This is where it get good! There are 3 possible paths that can be taken – straight-through, light touch, or full underwriting.

As you can see on the accompanying graphic to the left, if your client meets certain criteria, they can zip through underwriting with minimal delay. The healthier that they are, the faster things will move. The byproduct of this is that more underwriting attention is given to the complex cases which also move things along more rapidly.

Of course, there are a couple of things that will always slow any process …

- A client’s slow response,

- A delay in scheduling and completing a cognitive or paramed exam if that is required, and

- Slow response my medical professionals for APS.

If you want more information, please contact my internal sales partner Kelley Hilliard at kelleyhilliard.isp@oneamerica.com or at (844) 623-4251.

You must be logged in to post a comment.