About a year ago, I posted about funding an asset-based long-term care policy (Asset Care) using qualified money. Last week, I did the same. Essentially, it was the same information just updated to 2025 standards. Do you know what both posts have in common?

The volume of feedback!

One cluster was simply this – “tell me more about the program, who it might benefit, and if there are alternative approaches for funding an Asset Care policy with qualified money.” This is who today’s post is directed to.

This is a funding play that works with all of our Asset Care product variations (2019, 2024, and the CA version). We will be discussing the non-California approach since I am focused on the northeast.

Note: The California version does work differently so please reach out to your back office, Nick Angelov (my internal), any member of the OneAmerica Financial Care Solutions sales team, or myself.

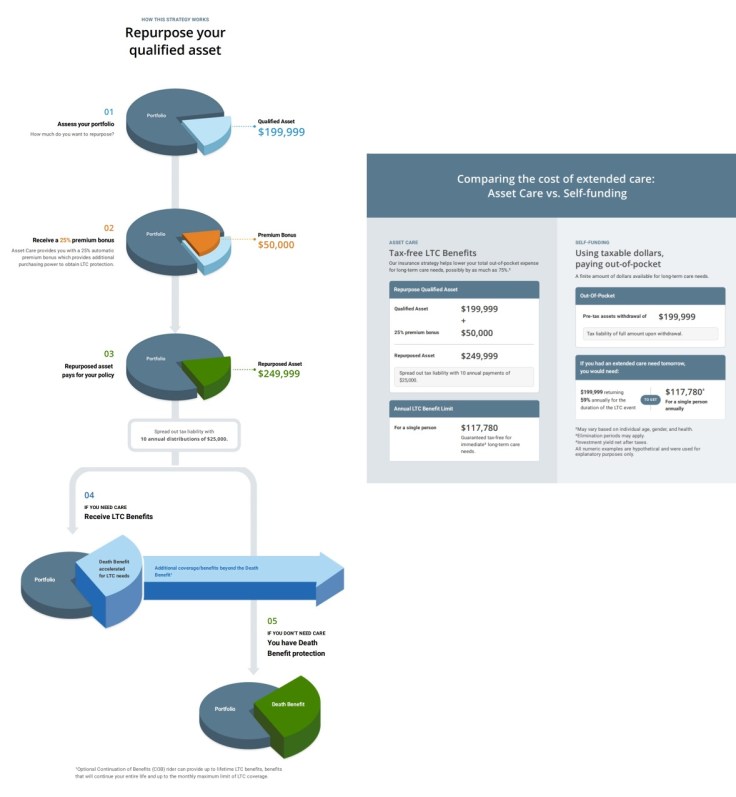

As a refresher, there are two parts to the strategy – the funding mechanism and the Asset Care policy itself. The funding mechanism is comprised of a qualified deferred annuity which feeds the Asset Care policy premiums for 10 years. The rollover is tax-free; the distributions for premiums will be taxed as ordinary income when distributions are made and reported via 1099.

That premium flows for 10 years into an Asset Care policy funding both the base life insurance policy and the continuation of benefits rider. The funding component is the only “static” piece of the strategy.

Here is what I mean.

This strategy will work for both individual & joint Asset Care policies AND can include any benefit design. It can be short and fat (base only design), can be a limited duration pool of money, or it can be a long and unlimited benefit strategy. It can include inflation or exclude inflation. Simply, the benefit design can be built to accommodate the needs of the client.

The target audience for this strategy is people who are between ages 59 ½ and 80 with large amounts of qualified money, people nearing age 73 where Required Minimum Distributions will be taken from their qualified money, or people over the age of 40 who are nonspousal beneficiaries for qualified plans.

For the nonspousal beneficiary situation, you can find more information and an example in my Fridays with Fisher post from October 25, 2024.

There are other approaches that can be employed to deliver qualified money into an Asset Care policy. Utilizing a single premium immediate annuity, or by turning on an income rider on qualified deferred annuity, or setting up a sweep account,or actively managing the qualified money and cutting a check.

There are a bunch of alternatives to the solution presented by OneAmerica Financial called Annuity Funded Whole Life (Asset Care). But, there is only one strategy that is turnkey – the one offered by OneAmerica.

For more information, you can the Care Solutions Sales Desk at (844) 623-4251.

You must be logged in to post a comment.