Last week, I shared my concern about the fallacy of having $1.5 million in assets (excluding your home’s value) being enough to skip LTC insurance. Boy, did I get some feedback on that – some was supportive; some was not so kind.

If you recall, I did say “you can rip this apart in a billion different ways.”

Some called me out telling me that this is not a reasonable scenario. Maybe the critics should speak with the couple that I am using as a basis for the example – they are real and this is their situation.

I acknowledge a change in one factor can impact the scenario – in some cases considerably.

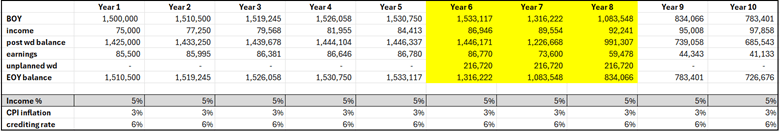

In my example, the couple was from NH and in their 70s. They had $1.5 million in assets ($1.0 million in qualified money spread across stocks & bonds plus another $500,000 in a nonqualified deferred annuity) which was generating $75,000 per year with the distribution increasing at a rate of 3.0% annually. (Here is a discussion of performance over the past 50 years from Craig Isrealsen, Ph. D. at 7Twelve Portfolio.)

Let’s talk about what’s important, the fact that the “self-insurance” strategy as their advisor called it, stumbled after 3 years. I’ve highlighted the 3 years for you.

Imagine if this was a longer duration event and not an average duration event which (by the way is reflecting today’s cost of care for home care based upon the national average) without any inflation being applied to it. The cost can be found using the OneAmerica Financial Interactive Cost of Care Map. This was for 18 hours a day of home care for 3 full years.

So, let me plant this seed … because “they have enough money” and BEFORE the situation arises, wouldn’t it be a good idea to determine the most tax-efficient way to “self-fund”?

I hear this often – when you allocate nothing, you allocate everything meaning everything is in play and, in all likelihood, most inefficiently.

So, let’s consider designating where the money will come from for a care event.

You must be logged in to post a comment.