There are a few things going on with Asset Care – the industry leading life insurance based long term care policy.

- Re-introduction of 4% acceleration for joint policies.

- Introduction of new plan design for joint policies – 50 month continuation of benefits rider

- Launch of new illustration consumer presentation for Asset Care

4% Acceleration for joint policies

One thing that OneAmerica prides itself on is the ability to devise custom long term care funding strategies to meet their clients’ unique needs. With this in mind, the 4% acceleration option for joint Asset Care policies has been re-introduced effective July 26, 2023.

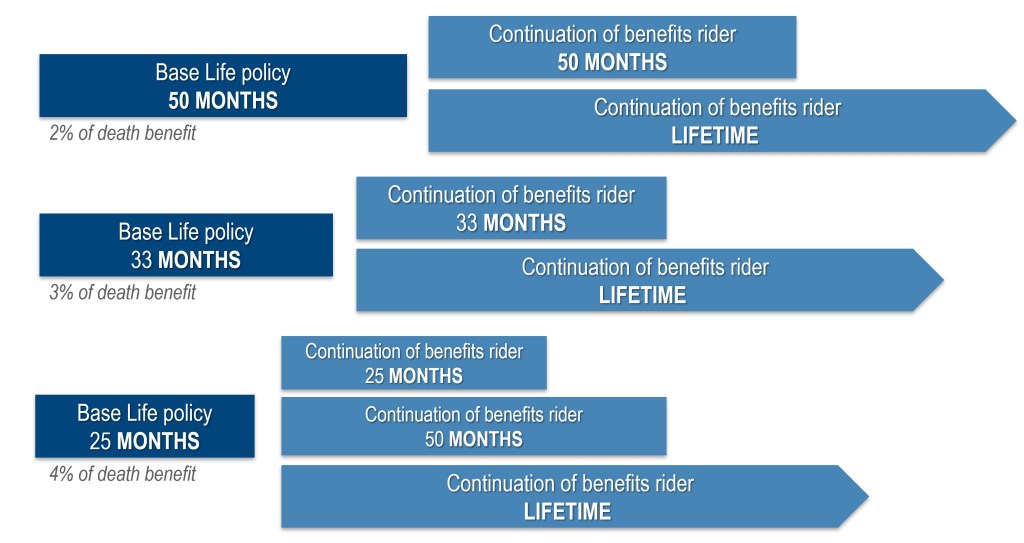

As a reminder, Asset Care benefits are driven by accelerating the policy death benefit at a rate of 2%, 3%, or 4%. At application – the rate of acceleration, along with any other riders (continuation of benefits, inflation, or nonforfeiture provision), must be elected.

The rate of acceleration and death benefit directly impact premiums and benefits … a good rule of thumb here is that if you want a “thick” death benefit, the elect a 2% acceleration; if you want a “thick” long term care benefit, then elect a 4% acceleration.

This acceleration of benefits is considered to be the base for any Asset Care policy and comes with both guaranteed premiums and guaranteed benefits (live, die, or quit). Since this is an asset-based policy, as claims are paid – the death benefit and cash value are reduced dollar for dollar by that claim amount. If the benefit available exceeds what is billed, then the difference remains in the policy. There is no loss of benefits with Asset Care.

Once the base policy is exhausted, the continuation of benefits rider will seamlessly continue to pay the claim until the claim terminates or the policy benefits are exhausted. And remember this … Asset Care is the only asset-based long term care carrier that offers unlimited lifetime benefits!

Cases issued on or after July 1, 2023, can be reissued upon request and submission of a new illustration. Requests must be received by your case manager no later than Aug. 31, 2023. The illustration will not require a client signature. And, cases that have been submitted and are pending can be converted to the 4% acceleration by submitting a new illustration and contacting either Justin Fox or me.

NEW – joint plan design continuation of benefits rider option

Along with the 4% acceleration option relaunching for joint Asset Care policies, a new continuation of benefits rider duration of 50 months has been added. Now, just like with an individual policy – a couple has the opportunity to elect a continuation of benefits rider of 25 months, 50 months, or unlimited lifetime.

Again, this provides you with more planning flexibility as OneAmerica does not believe in a “one size fits all” approach to planning. As with the introduction of the 4% acceleration enhancement, please contact either Justin or me if you have questions.

NEW – consumer illustration output for Asset Care

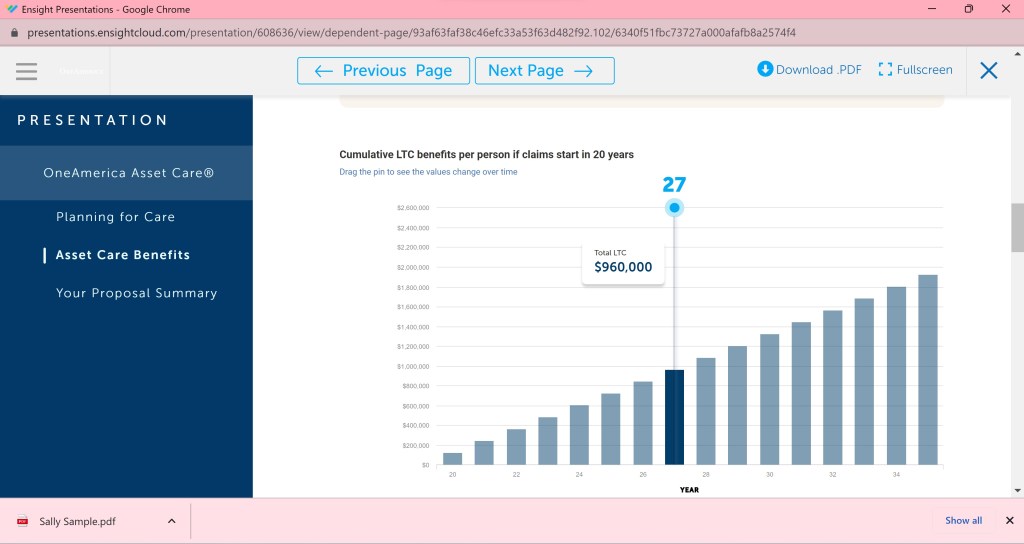

Coming in a few days – a new Asset Care consumer illustration option will be available for single premium and recurring premium illustrations (individual or joint policies). This optional new report can help with the “why long term care insurance” conversation as well as provide an example of how their unique plan can work.

Here is what makes it cool. You have the ability to share it with your client as either a hard copy leave behind, as a .pdf file, or as link (it will have a unique url and include your contact information). Think about how much this can strengthen your conversation.

What makes this really cool is that when used interactively (via url in a browser), you can interactively model the “what if” scenario to answer their questions … what if I don’t need care, what if I need 10 year of care, etc.

And, this consumer piece is unique to each. There is nothing like this in the industry – until now.

Next week, we will have more information about when, where, and how you can access this NEW and powerful presentation tool.

A training / review session schedule will be released shortly.

For an in-person and/or custom training, please contact either Justin Fox (my internal) or me directly.

Remember, your clients who are over 75 and own annuities can secure long term care insurance. That is what the million dollar annuity strategy is all about. Learn more about it at https://fridayswithfisher.com/million-dollar-annuity/.

My “big ask” of you for the million dollar annuity strategy is to identify 3 or 4 annuity owners 75 or older who might be viable candidates for our leverage strategy then give us a call.

Don’t forget to join Elaine Marvin, Niki Johns, Jen Wagoner, and me every month when we share something new with you on Coffee Break. In our July episode, we discuss averages and longevity. Our August episode will be focusing specifically on Asset Care.

You must be logged in to post a comment.