Over the last few weeks, I shared information about costs and durations of care. I also shared a little bit of an editorial opinion about the dangers of planning for the average.

Today, I want to share with you a true story that hist close to home.

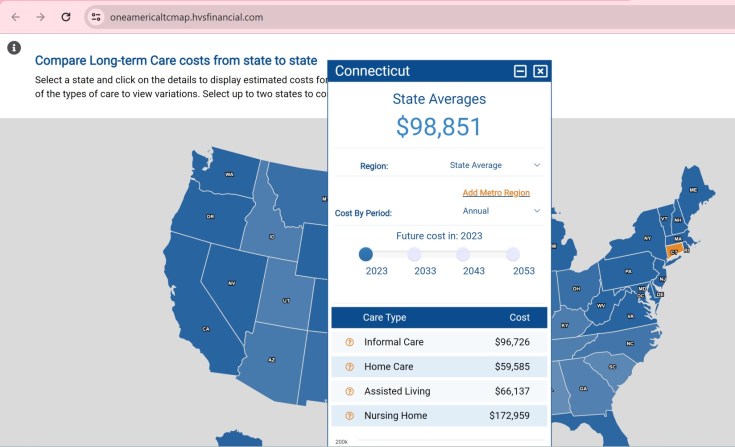

To set the groundwork, we will be talking in today’s dollars without any inflation factored in for simplicity sake AND using the AVERAGE cost of care for the state of Connecticut. Our focus will be on the cost of care and not how those services were paid for.

Grampa Mike was one of my closest friends father and a great man who included my family as part of his when we relocated many years ago. He had a huge heart, a great sense of humor, was beloved by friends and foes, and had a wife of 50 years when we first met. I truly cannot say enough good stuff about him.

Anyway, one day, Mike was golfing with his buddies (he was the youngest member of the group at 75) and he earned his name “Aquaman”. They were playing in the “Seniors Tournament” at his country club – his tee shot came to rest about a foot to the right of a water hazard. When he addressed the ball, he slipped and went for a swim – hence the moniker “Aquaman”. Along with the title can a bout with pneumonia short time later which started a downward spiral for his health.

About a year after his recovery from pneumonia, at age 77, he had a heart attack which impacted him. His recovery was respectable at first, but there were collateral issues that impacted his mobility and fine motor skills. He decided for the sake of his family that they would bring in a trained home health aid for however long it took for him “to get back to normal”.

He and his wife decided that they would need help overnight and in the mornings. That accounted for about 16 hours a day. For a week’s worth of care, they spent $2,282* (that is $9,930 per month). He received this care for 17 months before achieving independence once again. Just a reminder that we are using the average cost of care in CT in today’s dollars.

*weekly cost of care formula: ((daily cost of care x 2) x 7)

A couple of years passed without major health issues, then he took a spill while returning home from a football game. Fortunately, his son was there to minimize the impact of the fall, but the result was significant – major damage to his right knee and hip. He never recovered fully from the fall.

As you would expect, this required some major work and rehabilitation. He did a short stint in a nursing home during rehab before “recovering sufficiently to return home”. But, he was still incapable of transferring and other problems like dressing and eating became issues due to his frailty.

Like the first round, Mike and his wife decided – for his wife’s health (physically and emotionally) as well the sake of their relationship with their son and his family – that they would bring back their home care aid on a full time basis. That is $3,423 weekly** ($14,895 / month). He received that care for 29 months before he progressed to a point where home care was not feasible.

**weekly cost of care formula: ((daily cost of care x 3) x 7) And, remember, for this discussion, we are using the average cost of care in CT.

He moved into a top rated nursing home where the care was exceptional and the cost was high. For the next year and a half, every day, Mike’s wife would eat lunch and dinner with him until he said for the last time “thanks for talking to me” and quietly passed away. The monthly cost of care was $14,413.

Round 1 home care $ 9,930 17 months $168,810

Round 2 home care $14,895 29 months $431,955

Nursing Home $14,413 18 months $259,434

Total cost $13,441 64 months $860,199

A final reminder, these costs are today’s AVERAGE costs for the state of Connecticut. The actual costs were much higher given the high level of care elected by the family.

Mike had a great run. Words cannot adequately express how much he meant to me, my family, and everyone that he ever met. He was the rock for his son and grandchildren who he took immense pride in watching them grow from little kids into full blown adults.

Here’s one thing that money will never be able to replace – the memories. While he was working to recover in both instances, he (his wife, and their care provider) did everything that they could to make it to their grandson’s soccer matches. He didn’t make the long road trips, but he missed only 1 home game in 3 years and hosted a pizza party once a month at his house for the team. That is something that was noted by his grandson’s teammates at Mike’s service. The quality of care improved their quality of time together.

The reason why this experience turned out the way that it did was 2-fold. Mike and his wife had a plan which they shared with their family. AND, they funded that plan with a stout long term care insurance policy which covered almost 95% of the costs of Mike’s care.

This is a story of triumph and demonstrates how planning can help manage the difficulty of an extended care event.

Just a reminder, last week, we released a NEW Care Solutions Coffee Break. This month’s topic is having “the conversation” and a few ideas that you might find to be helpful.

It is the end of the year which makes it an ideal time to review your book of business and identify your clients who are over 75 and own annuities that are on the sideline and earmarked for an emergency. The share the story how that money can be transformed into a tax-free long term care insurance strategy. That is what the million dollar annuity strategy is all about. Learn more about it at https://fridayswithfisher.com/million-dollar-annuity/.

My “big ask” of you for the million dollar annuity strategy is to identify 3 or 4 annuity owners 75 or older who might be viable candidates for our leverage strategy then give us a call.

You must be logged in to post a comment.