Last week’s Friday’s with Fisher was focused on the “base-only” repurposing idea for Annuity Care & Indexed Annuity Care. If you missed it or want to review, check it out.

Do you remember my challenge?

If you do not, here it is again … take a look into your book of business and identify clients who are:

- Between the age of 70 and 85

- Own a nonqualified deferred annuity that is not being used for income

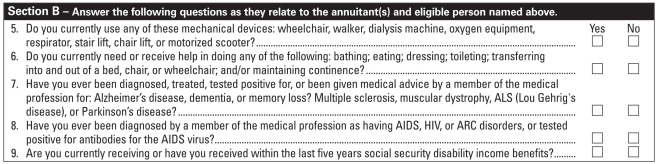

- Can answer the 5 underwriting questions favorably

Remember, for base-only Annuity Care or Indexed Annuity Care , when your client answers those questions favorably and the application is submitted electronically, THERE IS INSTANT APPROVAL UP TO $1 MILLION!!!!!!!!!!!

If you have questions about how to submit electronically, please contact Justin Fox at (844) 658-3725 or justinfox.isp@oneamerica.com or Nick Angelov at (844) 623-4251 or nick.angelov@oneamerica.com

Last Friday after he read the Fridays with Fisher email, Josh from New Jersey called me with a potential opportunity. He had a client (age 79) with an old variable annuity that had an account value of just under $350,000 with almost $275,000 of it as gain ($75,000 basis).

The original purpose was to augment their retirement income but that was never required. The old annuity simply grew and grew sitting as an idle asset waiting to be liquidated in an emergency or passes on.

After a meeting with the client to learn more about their intention for the annuity, a decision to 1035 exchange into Indexed Annuity Care was made. The application was submitted electronically, the decision was automatically approved, and the 1035 exchange is in line to be processed.

For the client, their new annuity will continue to grow tax-deferred and when needed for a long term care event transform into tax-free distributions. And, in place of paying income taxes for distributions made for long term care on over $275,000; all of the money distributed from Indexed Annuity Care will be tax-free for LTC.

For the writing agent Josh, this represented possibly the last opportunity to help his client fund a long term care event by putting a dedicated funding source in place.

Remember, this is all made possible by the Pension Protection Act which allows that meet specific criteria to transform the gains into a tax-free distribution when used for long term care support & services. And, there are very few annuity products that are PPA compliant.

Learn more about the “base-only” opportunity by contacting Justin Fox at (844) 658-3725 or justinfox.isp@oneamerica.com or Nick Angelov at (844) 623-4251 or nick.angelov@oneamerica.com

You must be logged in to post a comment.