For a little over 2 years, I’ve talked about biggest secret in long-term care funding – using nonqualified deferred annuity proceeds as a strategy.

I first shared with you the Million Dollar Annuity idea focusing on Indexed Annuity Care. In fact, I’ve even dedicated a specific page in Fridays with Fisher for it and have an archive of supporting materials. Times have changed and the idea has evolved, but the fundamentals remain the same.

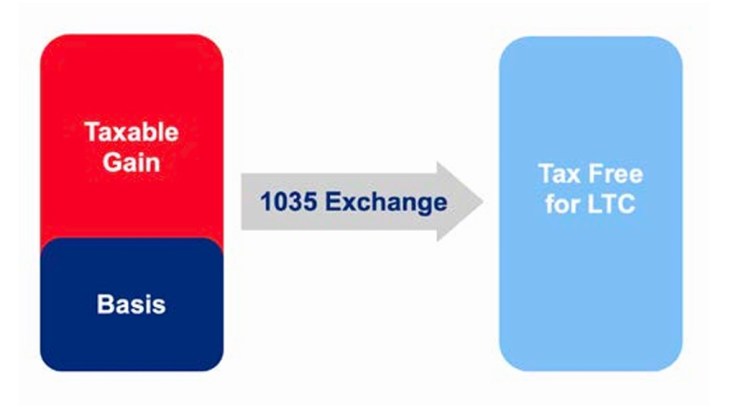

This opportunity is made possible due to Section 844 of the Pension Protection Act (PPA) which allows for cash value life insurance and deferred annuity proceeds to be exchanged tax free into “annuity and life insurance policies with a long term care feature.”

The focus of the Million Dollar Annuity idea has shifted to one that seeks to leverage the tax code for annuity owners who are age 85 and under with a nonqualified deferred annuity that is not intended for income but is likely to be one of the first financial resources utilized when a long-term care event occurs.

By identifying the bucket of resources to be used to fund a long-term care event, clients are taking one important step to removing some of the stress that their family will feel.

Learn more by going to the Million Dollar Annuity page on the Fridays with Fisher site.

Or, you can contact Justin Fox at (844) 658-3725 or justinfox.isp@oneamerica.com, or Nick Angelov at (844) 623-4251 or nick.angelov.isp@oneamerica.com, or myself at (678) 512-9627 or kevin.fisher@oneamerica.com

You must be logged in to post a comment.