Do you have a client the owns a nonqualified deferred annuity?

Odds are that you do. I read in an online article from the Insurance Information Institute that over $3.667 trillion are held in annuity assets (based upon a LIMRA data released in early 2024). And, someone is selling a lot of them because the same article shared that in 2023 over $385 billion dollars in annuities were sold.

So, even if you didn’t place an annuity with your client, another agent or advisor may have.

Consider all of your clients who own annuities and ask this question – has the purpose for that annuity changed? According to annuity-insurers.org, 65% of individual annuity owners are retired, with an average age of 70, but the average age at which they first purchased an annuity was 51.

Think about this for a moment. If the average purchase age is 51 and almost 2/3 of retirees own an annuity, what are the odds that the purpose for that annuity changed? Maybe it was originally bought as a way to fund their retirement income but they have no need for it. Maybe it was a pure interest rate play as a CD alternative. Regardless of the original intent, what is is being used for today?

In a Gallup survey from 2022, 79% of annuity owners indicated that their annuity was a financial tool to help them avoid becoming a burden to their children and 67% saying that it serves as an emergency healthcare fund in the event of a catastrophic illness or a nursing home care.

Again, has the original purpose for the annuity purpose changed? There is only one way to know – ask the annuity owner!

So, let’s say that things have changed where the annuity is not needed as part of their retirement income plan and transitioned into one of their key components of their emergency funding.

Just because the purpose changes does not mean the tax treatment changes. With most deferred annuities (notice how I say most), taxes are paid on the gains regardless of the reason for a distribution which is typically done on a last-in first-out basis.

With an annuity like Annuity Care I and Indexed Annuity Care which is Pension Protection Act compliant, distributions made for extended care / long term care purposes can be made tax-free! And, during the time until they require care, the annuity will continue to grow at a modest rate.

They offer an opportunity for annuity owners to simply move the annuity money into a vehicle better positioned to deliver their money when an extended care event occurs.

Repurposing that annuity is as simple as a 1035 exchange into Annuity Care I and Indexed Annuity Care.

Who is the ideal client? Annuity holders who are between 70 & 85 who have nonqualified deferred annuities with gain.

Is there a maximum limit? In both instances, up to $1 million in 1035 exchange can be accepted. AND, full compensation is paid up to $1 million.

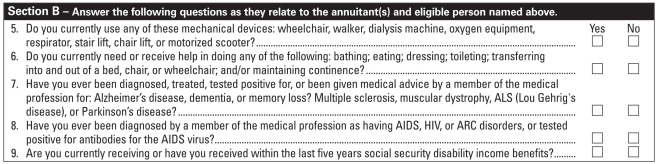

Do they need to be underwritten? Yes, but it is only 5 questions. When the client submits the application electronically and answers these questions favorably, the approval is INSTANT!

Let me say that again and I am going to shout this time …

WITH A BASE-ONLY ANNUNITY CARE OR INDEXED ANNUITY CARE, WHEN THE CLIENT ANSWERS THE 5 UNDERWRITING QUESTIONS FAVORABLY, THERE IS INSTANT APPROVAL UP TO $1 MILLION!!!!!!!!!!!

My challenge to you is this – look into your book of business and identify clients who are:

- Between the age of 70 and 85

- Own a nonqualified deferred annuity that is not being used for income

- Can answer the 5 underwriting questions favorably

Then, contact Justin Fox at (844) 658-3725 or justinfox.isp@oneamerica.com or Nick Angelov at (844) 623-4251 or nick.angelov.isp@oneamerica.com

You must be logged in to post a comment.